For many entrepreneurs the way to start a business is through the bank or other credit lending institutions. But there is the good and the bad about that kind of credit The good news is that it is readily available and that the limits depend entirely on the enterpreneur's security. The bad news is that it is quite difficult to qualify for such credit, especially when you have a bad credit.

But do not be troubled if that is the case with you as this article is meant to sho how entrepreneurs with bad credit can fund their business.

1. Seek an underwriter

Also known as a guarantor, he/se may consist of any individual - friend, companion or relative who takes up the place of the entrepreneur in order to secure the credit. That individual must quality the bank's criteria.

The bank's choice will be founded on the underwriter's resources and financial record. The guarntor should likewise be conscious of the dedication, since the transaction will show up in their credit record and may constrain their credit limit. They should likewise be sure about the degree of their risk should the entrepreneuur not be able to fulfill your commitments.

2. Join with other individuals

As an entrepreneur, a bad credit can be a disaster. It implies that you can't only lift your business, but you also will find it difficult to expand or grow like similar businesses whose credit is good. In any case, as the adage goes; when you can't beat them, join them them. For instance, you can collaborate with those with great credit advantage in a joint venture with the aim of obtaining a loan with the advantage of their and use those funds in your business. Although you will still have some interest plus principal to pay monthly, this method is a life saver for many business out there.

In any case, in such a circumstance, it is vital to have a legal counselor draft an understanding deciding everybody's duties and obligations when the stake is procured keeping in mind the end goal to ensure a risk-free environment. However, the method is generally secure and ideal for entrepreneurs because if anything happens the risk is spread across all parties.

3. Avoid too much ambition and apply purchase order financing

All new businesses require some petty cash for them to keep running and get off the ground. It gets uglier when the business eats into that petty cash and due to constant hefty borrowings out of too much ambition, have landed them in deeper credit problems. If the business is not generating some money which means that it is even unable to meet its costs, it is not recommended to take up a loan as that only means that the business might probably not pick any time soon. Entrepreneurs who have been tempted to take big amounts of loan to salvage such businesses have only signed a death sentence for their business, with the 'noose' being a bad credit record (no pun intended).

Instead, such an entrepreneur should apply a business survival strategy, such as the purchase order financing. Purchase order financing is yet another good alternative for entrepreneurs with a bad credit. This strategy involves using funds for a particular line of business in another line to keep it going. There are situations when an entrepreneur, say, a book seller, needs to boost the productivity in a particular line of books, so he uses the sales from another to boost the prioritized line, only to refill the borrowed line later. In a layman's illustration, it is akin an internal borrowing system where one section lends another some capital and then the entrepreneur adjusts gradually. So when is impossible to borrow funds due to bad credit, an entrepreneur can still acquire some capital from the same business to boost the potential line. While the advantage of this method is that it is risk free and low cost, its main disadvantage is that it is limited in funds.

4. Correct your credit situation

Last but not least, it is essential to get your record of loan repayment straight first. Some of the time, what the bank might be in a position to loan to you may be way higher than what makes your credit to look bad. For example, you may have some important resources, such as, a car, a house, or even a plot of land, yet what disqualifies your credit is just a couple of several dollars. In such a circumstance, it is fitting that you sacrifice a couple of your assets with a specific end goal to clean the terrible record and thus meet all requirements for the credit.

There are more approaches to clean your bad record, including; enhancing your monetary circumstance by paying your bills on time, clearing the full adjust of your credit card periodically, utilizing your credit restrain wisely, and keeping the number of advance solicitations to a low.

So, the next time you are denied credit because you were unable to pay on time or were too ambitious such that you were unable to pay the full sum, do not worry, just look at these options and decide which one best fits your situation.

Written by: Bclique Staff Writer

We Connect Entrepreneurs With Partners to Start, Fund or Grow Your Business.

Most Recent Articles

Should Mark Zuckerberg cash in now, are we seeing the beginning of the end?

Should Mark Zuckerberg cash in now, are we seeing the beginning of the end? Does Tai Lopez Millionaire Mentor ship program really work?

Does Tai Lopez Millionaire Mentor ship program really work? Social network to help people get rid of unproductive friends launched

Social network to help people get rid of unproductive friends launched 20 Best crowd funding tips.

20 Best crowd funding tips. What not to tell your Angel Investor?

What not to tell your Angel Investor? HOW TO RUN AN EFFECTIVE CUSTOMER SERVICE IN A DIGITAL WORLD

HOW TO RUN AN EFFECTIVE CUSTOMER SERVICE IN A DIGITAL WORLD 8 important Facts That All Sales People Should Know

8 important Facts That All Sales People Should Know 5 Great Facebook Marketing Tips That YOU Will Fail Without

5 Great Facebook Marketing Tips That YOU Will Fail Without 5 Best Instagram Marketing Tips for Your Business

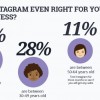

5 Best Instagram Marketing Tips for Your Business 10 Best Marketing Tips for Small Business

10 Best Marketing Tips for Small Business